Table Of Contents

What Is A Put Option?

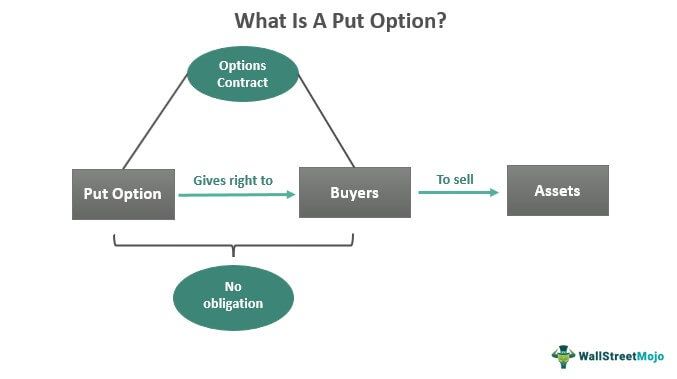

A put option is a contract that offers buyers the right to sell an underlying security at a predetermined price even before the expiration date. Most investors opt to engage in such deals considering the continuous fall in security prices. However, the options contract only reserves the right to sell and is not an obligation of any form.

The call and put options differ with the former helping buyers reserve the right to buy for the traders, who are allowed to purchase an asset at a pre-decided price within a specific time range. On the other hand, the put options allow traders to hedge to the maximum possible extent.

Key Takeaways

- A put option is a contract that gives the buyer the right to sell the option at any point on or before the contract expiration date.

- This is essential to protect the underlying asset from any downfall of the underlying asset anticipated for a certain period or horizon.

- There are two options: long put (buy) and short put (sell).

- It becomes valuable as the exercise price exceeds the underlying asset. Conversely, the option loses value as the underlying asset exceeds the exercise price.

Put Options Explained

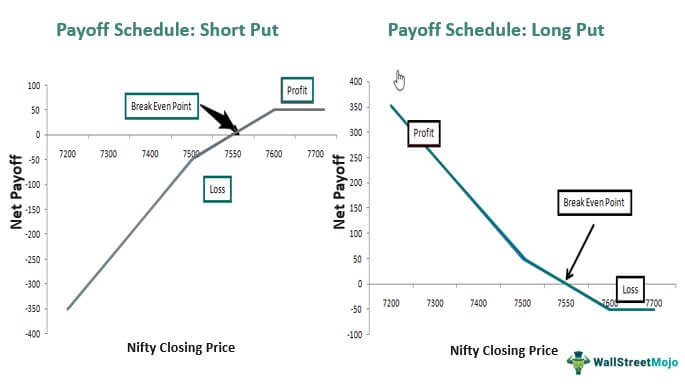

Put option meaning involves significant payoff as the prices of the underlying asset in question decrease. In short, the security value increases with the falling prices. Such options are available in two forms – Long Put and Short Put.

Long put is when the investor is buying a put option. It is usually a trade taken when the investor anticipates that the underlying asset will fall during a certain time horizon. The option, however, protects investors from running into losses.

On the other hand, a short put is where investors sell a put option, which is also referred to as writing a put. It can be sold if an investor anticipates that the underlying asset will not fall over a certain period. This will also ensure that the option seller generates income if the buyer doesn’t exercise the option by the expiration date.

The put option strategy is used to manage risks, becoming a protective put for traders, whether they act as buyers or sellers. This form of investment insurance helps hedge risks involved with the underlying securities to a certain extent.

While the investor is a buyer or seller in the option, the option can either be in the Money, at the money, or out-of-the-money at expiration.

- In-the-Money is when the strike price exceeds the underlying asset, X > ST.

- At-the-Money is when the strike price equals the asset in question, X = ST.

- Out-of-the-Money is when the underlying asset exceeds the strike price, X < ST.

Here ST is the strike price, the predetermined price of the security.

Formula

If the current stock price is S, the strike price is X, and the stock price at expiration is ST. The premium paid is p0. Then, the profit for the put option buyer and seller can be calculated as below:

- Put Payoff for Buyer

The put buyer will earn a profit when the exercise price exceeds an underlying asset and premium.

PT = Max (0, X – ST)

Net Profit = PT – p0

- Put Payoff For Seller

The put seller will earn a profit if the exercise price moves below the underlying asset or does not have a large movement below the strike price. Thus, the seller can earn the premium that he receives from the buyer.

PT = – Max (0, X – ST)

Net profit = p0 – PT

Examples

Let us consider the following example to understand the put option meaning even better:

Example #1

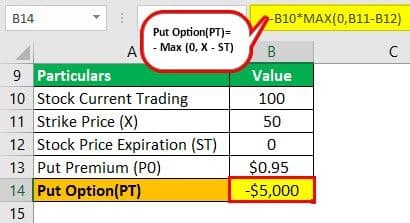

Let us calculate the profit or payoff for the put buyer if the investor owns one put with the put premium being $0.95, the exercise price being $50, the stock is currently trading at $100, and the stock trading at expiration being $40. Assume one option equals 100 shares.

As given in the above example, we can interpret that an investor has the right to sell the shares at a strike price of $50 up to the expiration date. However, if the stock falls to $40, the investor can buy it at $40 and sell it to the option writer at the agreed strike price of $50 each.

Thus, the payoff can be calculated if the investor wants to make a profit.

PO = PT = 100 * Max (0, 50 – 40) = $1000

Moreover, the gross payoff must be subtracted by the premium paid on the put option or less if any more commissions are paid.

Net Profit = 1000 – (100 * 0.95)

Net Profit = $905

Thus, the maximum gain is earned until the stocks fall to $0. On the contrary, the maximum loss is incurred up to $95, which is the amount paid as the premium.

Example #2

Let us calculate the profit or payoff for the put writer if the investor owns one put option with the put premium worth $0.95, the exercise price being $50, the stock is currently trading at $100, and the stock is trading at the expiration at $40. Assume one option equals 100 shares.

In this case, the put writer must purchase the underlying asset or take the delivery. In the example, if the stock price at expiration had ended above the strike price, then:

- The put buyer lets the option expire and does not exercise the option as the stock price at expiration is greater than the exercise price.

- The investor who had expected the stock price to rise now collects the put premium price of $95 (Payoff = 100 * 0.95) by selling an option at an exercise price of $50. This, however, becomes the maximum profit for the put writer.

As shown in the above example, the underlying stock price is less than the strike price. Here, the option writer must buy the shares at $50 even if the underlying stock price falls to $40 or below. Here, the loss calculated would be:

PO, PT = – 100* Max (0, 50 – 40) = -$1000

The net loss is calculated by subtracting the premium from the gross loss.

Net Profit = -$905

Theoretically, the maximum loss can be as high as the strike price for the number of shares if the underlying asset price falls to zero. Thus, the calculation is shown below:

PO, PT = – 100* Max (0, 50 – 0) = -$5000

Here the net loss is calculated by subtracting the premium from the gross loss of the put.

Net Loss = -$4905

Put option vs Short Selling

Put options and short selling are two trading strategies that help traders secure their position while the prices of the underlying assets are falling. Traders choose between the two and their suitability for a particular activity in a bearish market.

The major differences between put and short selling are listed below in a tabular form:

| Put Option | Short Selling |

|---|---|

| Fits directional deals involving individual security | No expiration date; traders can wait for as long as they find suitable |

| Limits risk, maximizes returns | Losses can be significant as it involves margin loan and interest charges on the short sale |